The European Commission proposes to extend the suspension of fiscal rules for the whole community until the outbreak of the coronavirus crisis for an additional year. Brussels will continue to allow member states flexibility in spending public money in an economy that is being smothered by high inflation, war in Ukraine and threats of Russian gas supply cuts. This means that the EU's public deficit could exceed 3% of their GDP in 2023. That was the historical rule. They should also not reduce their public debt below 60%, another limit imposed on them by the EU.

The extension of the escape clause, as these limitations are known, is an important measure for Spain which will hold general election in 2023. According to Brussels estimates the Spanish public debt will be 115.1% GDP this year and 113.7% by 2023. This makes Spain the country with the third highest level of deficit, after Portugal and Greece. The EU expects that member states will reduce their debt in the next two-years. However, 17 countries will surpass the limit of 3% this year and then drop to 11 next year.

The Community Executive, faced with this situation, proposed that the escape clause be kept in the package of measures for next semester. This was announced by the financial newspaper Financial Times on Thursday. This mechanism, which was suspended at the outbreak of the pandemic in 1918, must be extended. It is a demand that many States have already made and must be ratified by the EU Ministers of Economy and Finance next Monday at the Ecofin meeting.

All members of the club are not enthusiastic about the measure. The main beneficiaries of the clause extension will be Greece, Portugal, Spain and France. They are the most indebted states. Organizations such as the European Central Bank (ECB), however, have warned that rates should be raised in July to combat runaway inflation. The Bank of England and the US Federal Reserve have taken similar measures.

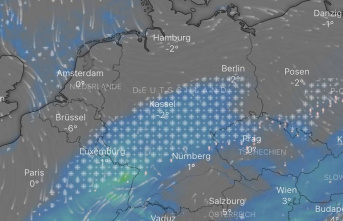

Everything suggests that Brussels will now certify that it will grant one year of credit to European countries in order to reduce their public debts. This will be after revising downwards economic forecasts for this region. According to the latest estimates, the European economy will slow down over the next two years due to the Russian invasion in Ukraine. It will grow 2.7% in 2018 and 2.3% by 2023. It has been raised and the Commission believes that it will continue to rise, causing a drop in activity and consumption.

The effects of the armed conflict won't be evenly distributed among the Member States. Eastern countries will suffer the most due to lower economic activity and higher inflation. They are also more dependent on Russia for their energy. The European Commission predicts a 4% increase in Spain's GDP this year due to the tourism boom.

The extension of escape clause gives more space to the discussion on reforming the Stability and Growth Pact. This has been under review ever since the outbreak of the pandemic. Spain and the Netherlands attempted to give an additional impetus to the modification at the beginning April by submitting a joint proposal to improve the balance of public accounts. The idea behind the fiscal rules is to adapt to each state's circumstances, allowing for economic growth, public investments, and reforms.