The Independent Authority for Fiscal Responsibility (Airef), the body created by mandate from Brussels after the great financial crisis to ensure the sustainability of Spanish public accounts, has decided to make a formal recommendation to the Government to assess the effectiveness and redistributive impact of measures such as the bonus of 20 cents per liter of fuel or the general reduction of VAT on the electricity bill from 21 to 10% before prolonging its effectiveness beyond June 30.

Without openly questioning the measures, Airef warns that a possible extension of these until the end of the year would add between two and six tenths of a percentage point to the public deficit and, above all, would take away room for maneuver to allocate the extra income from inflation to reduce the deficit and the public debt, which constitutes another of the recommendations that the Fiscal Authority makes to the Government.

The institution is beginning to be seriously concerned about the path that the deficit and public debt may take in the medium and long term.

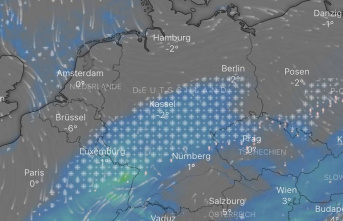

His report on the Update of the Stability Program of the Kingdom of Spain for the period 2022-2025, sent by the Government to the European Commission just two weeks ago, supports the official projections that predict sharp reductions in the deficit, from the current 6.8% to 2.9%, and debt, from 118.4% to 109.7%, but warns that in the absence of fiscal adjustment measures these advances, which will come astride the inertia of growth, will reverse and the public deficit will stagnate at 3% and public debt will skyrocket to 140% of GDP over the next five years.

"The high 'stock' of debt accumulated in recent years has increased the vulnerability of public accounts and the current situation of uncertainty has come to aggravate that situation," explained the president of Airef, Cristina Herrero, yesterday.

The Tax Authority is particularly concerned about the absence of a fiscal strategy by the Government to return public accounts to a sustainable path, something that the institution has been insisting on for months in its recommendations to the Government and that the latter systematically ignores.

The institution's report maintains that the government's strategy of trusting the reduction of the deficit and the debt to the inertia of growth of the economy, without adopting structural adjustment measures, has an expiration date and that in the best of cases it will not allow any extra progress in the process of consolidating public accounts when the gasoline of European funds runs out around 2024.

The panorama that Airef draws from then on is bleak. The deficit would stagnate at around 3% of GDP, just the border that marks the entrance on the scene of the almost forgotten 'men in black' of the Commission, and the debt would go to levels never seen in Spain until 140% of GDP. The situation is such that Airef calculates that even applying a budget adjustment plan of 0.35% of GDP (about 5,000 million per year) the accounts would not return to balance until 2035.

2