After learning that the European Agreement to veto 66% crude oil imports from Russia by the end of this year, the price of oil has not seen a respite. The Brent oil price has risen steadily over the past few days in anticipation of that community pact. It now stands at 124 dollars per barrel, its highest price since March 1, when Ukraine invaded. It ended up at 118 dollars per barrel. This is 0.5% less than Monday's settlement when the EU signed the aforementioned agreement.

The heads of state, government and parliament of the European Union agreed to lift the embargo against Russian oil from the pipeline that supplies Hungary. They were able to remove the sixth set of sanctions, which will allow for the end of imports by sea from Russia. This means that they can veto at least two-thirds of total oil reaching the Twenty-seven.

The agreement calls for an embargo on all oil imported from sea "before December 31st" and allows for a second phase, without any timetable, to develop the embargo applicable the Druzhba southern branch, which supplies Hungary, Czech Republic, and Slovak.

According to European sources, the member states will continue to work out the details to implement the partial embargo against oil arriving by sea. The goal is to close that portion of the agreement by the end of this week. In the next days, the exemption will be finalized.

The new increase in oil prices occurs just one month after the Government's measure to reward drivers with 20 Eurocents per liter of fuel refueled expired. The rise in oil prices has eroded almost all of the assistance given to gasoline and some diesel drivers in recent weeks. The average gasoline price was 2.25 euros on Tuesday, 18 cents higher than the beginning of April and 1.87 euros for diesel, five more.

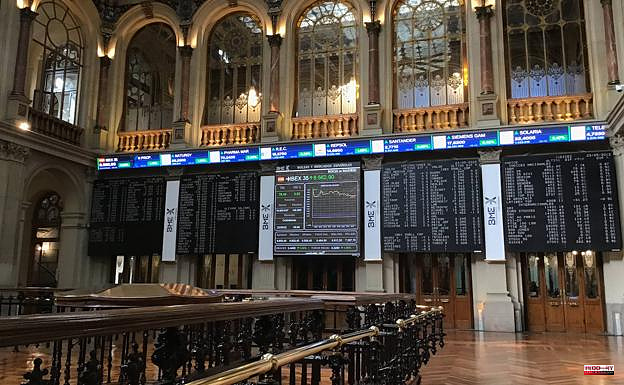

The stock market has seen the Ibex-35 fall by 0.89%. It has lost 8,900 points on Tuesday. However, it has experienced a rise in May of 3.11% that has allowed it recover losses it had suffered in the year.

The Spanish selective began 2022 with three consecutive months of declines due to the escalation in inflation and Russia's invasion of Ukraine. It recovered a portion of the losses in April, and it was May that it returned to positive ground in its annual balance.

Although the indicator started the fifth month of this year with fears of economic recession and blockades in China to prevent the spread of coronavirus spreading, optimism seems to be returning to stock markets. The market has been closely following the release of macroeconomic indicators as well as the messages from European Central Bank (ECB) which indicate a rise in interest rate in July and a return back to positive rates for September.

The Ibex-35 ended May at 8,851.5 points. This is an increase of 3.11% and 1.58% respectively. However, this Tuesday's session saw a decrease of 0.89%.

Telefonica (2.16%), Repsol (1.01%), Acerinox (1%), CIE Automotive (9.933%), and Rovi (0.56%) were the biggest increases of the trading day.

Contraindications: IAG (-4.91%), Amaadeus, (-4.62%), Fluidra(-2.07%), Santander (+2.06%), Almirall (0.01). Colonial (-1.8%) and 8%.

After the Twenty-seven agreed to an embargo against Russian oil, the session was marked by the return of activity on Wall Street, and the rise of the Brent oil price after it was purchased. However, the oil pipeline which supplies Hungary will remain open for future deliveries.

Russia has cut off gas supply to the Netherlands due to its refusal to pay in rubles the price of the energy product. This is in addition to other countries like Poland, Bulgaria, and Finland who have refused to pay for gas in Russian currency.

This scenario saw the Brent crude oil price rise by 1.45% to 123.43 USD, compared with yesterday's close. However, it is now above the threshold of 124 US dollars per barrel. The price of a barrel West Texas Intermediate oil (WTI), which is a reference for the United States, was 117.54 dollars. This was 2.13% higher.

On Tuesday, it was also reported that the interannual inflation rate for the euro area stood at 8.1% in mai, as compared to 7.4% in April and March. This is the largest increase in prices in the region's history.

The European stock markets closed their session Tuesday in negative with falls of 0.08%, 1.43%, Paris, 1.29%, Frankfurt, and 1.22% respectively.

The euro was priced at 1.0725 'greenbacks' against the dollar. The Spanish risk premium was 110 basis points. The interest rate on the 10-year bond was 2.216%.